Financial wellness is an ongoing game, which means you

regularly need to pause and check in on your accounts to see how things are

going. One way to do this is by assessing your net worth. But what does net

worth mean?

Understanding this is key to understanding your current

state of financial health so you can determine what you are doing well and what

changes you might need to make to reach your financial goals. The best way to

improve your Financial Health is to Track your Net Worth.

What Does Net Worth Mean?

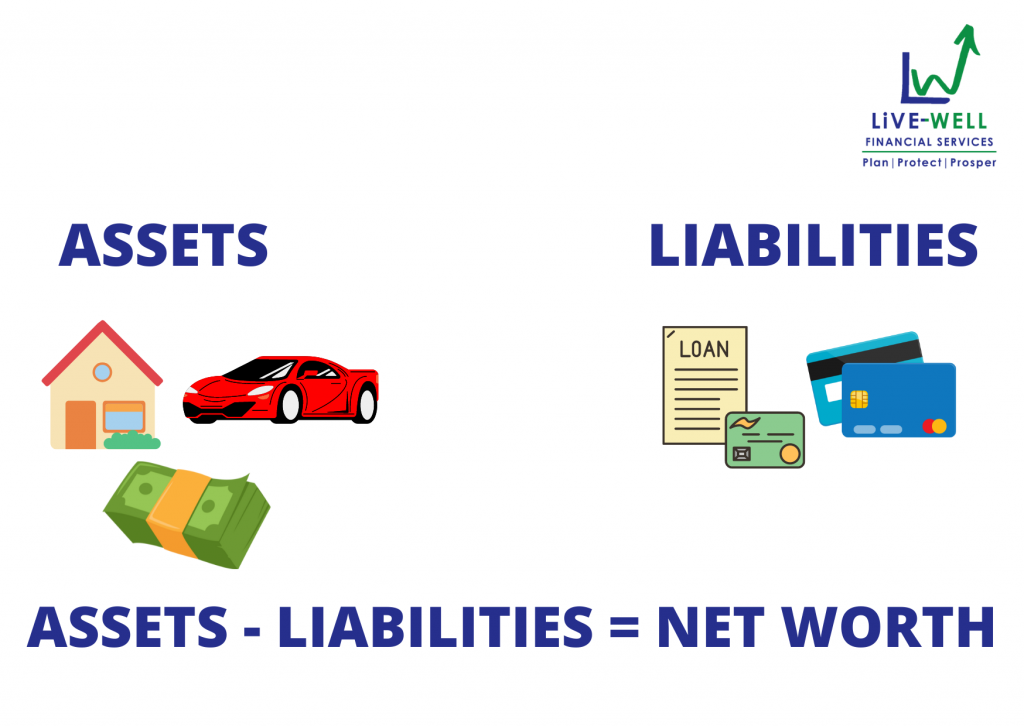

The net worth is the complete value of all your assets (i.e., what you own) minus your liabilities (i.e., what you owe). When you subtract your liabilities from your assets, the difference is your net worth. While most people have a positive financial net worth, it is possible for your net worth to be negative. This can happen if your total liabilities are more than your total assets.

It is important to keep in mind that your net worth is just one way to calculate your personal wealth.

How Do You Calculate Your Net Worth?

To calculate your net worth, you will want to total all your assets and all your liabilities. Here are some examples of common assets to consider:

• The approximate value of any real estate that you own, such as your primary residence

• Stocks or other investments

• Cash in savings accounts

• Personal property such as cars or jewelry

Some common liabilities that people have:

• The home loan outstanding for any property that you own

• Car loans

• Personal loans

• Credit card outstanding

Once you have a list of all your assets and liabilities, you can subtract your total liabilities from your total assets to find your net worth. It is important to note that regular expenditures — like your monthly phone/internet bill, rent, groceries, insurance premiums, etc — are simply expenses, not liabilities.

Why Knowing Your Net Worth Is Important?

Knowing your net worth can be important because it can help you to make sure that it moves in the right direction. When you pay attention to your net worth, you are much more likely to notice if there is anything that is preventing you from increasing your net worth.

Rather than comparing your net worth to that of your friends, family, or peers, compare it to yourself over time. When you track your net worth over time, you can see how it has improved over the past months or years.

How To Improve Your Net Worth?

Since your net worth is the difference between your total assets and your total liabilities, you have two different ways to improve your net worth. The first way is to grow your assets. Adding more money to your cash or investment accounts will increase your net worth. If your home appreciates in value, that will also add to your net worth.

The other way to grow your net worth is by shrinking your liabilities. One great way to do this is by paying down your debt. If you pay off your mortgage then that removes a liability from your net worth calculation.

Knowing and tracking your net worth can be important to keep yourself financially healthy. You can improve your net worth by either increasing the value of your assets or by paying down your debts. Both strategies can work to increase your overall net worth.